Comparing Scotland to the Nordic nations on a range of economic and social indicators is becoming something of a national pastime; it seems no current affairs publication or event is complete without an extended discussion over what Scotland could learn about [insert policy area x, y or z] from [insert Nordic nation a, b, c or d].

Nothing wrong with that. The Nordic nations are probably the most enduringly successful economies on the planet: fairer and more equal than the UK, more dynamic and innovative. Why not try to learn from them?

However, despite the valuable work of Nordic Horizons and others, political debate about what Scotland under current or new constitutional scenarios might learn from the Nordic nations is what might be politely described as under-developed. We know things are good over there but, more often than not, detailed policy prescriptions are absent.

Therefore, I hope this wee series of three blogs covering tax, economic development and work might help enhance the debate in areas important to the STUC. My intentions are very modest: the blogs certainly don't claim to provide a blueprint for a more Nordic Scotland and I’ll ultimately opt for the predictable researcher’s get-out clause of recommending more research. The aspiration is that together these blogs will form a useful contribution to a growing debate and one that might shift that debate towards areas hitherto overlooked. If some readers are provoked to look slightly differently at the nature of the Nordic models and the ways in which Scotland might learn from them then my mission will be accomplished.

Tax

“Personal and business taxes will not increase in an independent Scotland”, (or words to that effect) John Swinney, Cabinet Secretary for Finance, BBC Good Morning Scotland, 7 February 2013

“If the SNP want us to look to the Scandinavian example then they have to look at all the facts. The tax rates there are much higher than the current situation in the UK. Would they be recommending that we move to that sort of tax regime? Are they saying that Scots should be paying anything up to 60 per cent in income tax and 12 or 14 per cent VAT on food where they currently pay none?” Michael Moore, Secretary of State for Scotland

In what ways do the tax systems of the Nordic nations differ from Scotland and the UK? How important is the design of the tax systems to the enduring economic success of these nations? In seeking to cut corporation tax is the Scottish Government learning the right lessons from Nordic success? Will the poor really suffer, as Michael Moore implies above, from a more Nordic style tax regime?

Well, this blog isn’t even going to attempt to answer all these questions. Rather I’ll present some data and conclude with some thoughts on issues to consider as the independence debate gathers pace. I don't claim to be a tax specialist and wouldn't be too surprised if I've missed something glaringly obvious in the analysis which follows. Please don't hold back from pointing out such omissions or errors.

First, a very quick word on sources. The following data are drawn from three sources: Eurostat (thankfully Norway is included in Eurostat figures although not an EU member state), the OECD and the World Bank – although I might have issues with some of the policy work of at least two of these organisations, their data collection and presentation is (usually!) professional and neutral. I’m not aware of better sources but, again, please let me know of any I might have missed.

A good starting point for the discussion is…

1 Total taxation revenues (TTR)

As I stated in a recent article for the Scotsman, ‘…Most relevantly, total tax revenue is much higher in all four countries with Sweden and Denmark collecting at least 10% more of GDP in taxation each year than the UK’.

Between 1995-2010, average TTR as a percentage of GDP collected in Denmark and Sweden was fully 13% higher than in the UK; Finland 9% and Norway 7% higher.

Over the period, TTR fell in Denmark (-1.2%), Sweden (-2.1%) and Finland (-3.6%) and increased in Norway and the UK (both by 0.9%). However, at least some of the movements will be explained by fiscal responses to recession rather than long-term tax policy changes: Sweden’s TTR had actually risen prior to the recession (over 48% between 2004-06) but then fell quite steeply as the Swedish Government sought to stimulate demand through tax cuts. The opposite happened in the UK (it’s worth noting revenues fell more steeply in the UK over 2008/9 due to over reliance on finance) where the Government raised tax as part of their fiscal consolidation efforts.

To emphasise:

Denmark, Sweden and Finland are respectively the 1st, 2nd and 6th most taxed nations in the EU27. If Norway was in the EU it would be the 4th. The UK is the 14th most taxed nation in the EU. The three least taxed nations in the EU are respectively Lithuania, Latvia and Romania reflecting little more than their stage of development (less developed nations tend to have relatively low tax ratios);

In global terms the Nordics are very high tax jurisdictions: the EU, taken as a whole, is a high tax area: the sum of taxes and social security contributions averages 38.4%, some 40% above the levels of the US and Japan. Among the major non-OECD members only Canada and New Zealand have tax ratios exceeding 30% of GDP.

2 Progressivity

So the Nordic nations manage to collect much more taxation than the UK. But are their tax systems, as is commonly assumed, more progressive? I also argued in the Scotsman that:

“While the Nordics are highly redistributive nations, their tax systems are less progressive than the UK with much higher tax rates on consumption and labour. Indeed, it is not widely understood that the association between tax progressivity and overall redistribution across countries is negative. Redistribution is primarily driven by the level of taxation not its structure. Comparative evidence shows that affluent countries that achieve substantial inequality reduction do so with tax systems less progressive than the UK’s”.

However nothing in taxation is as straightforward as it seems. At first blush the Nordics' tax regimes do appear to have at least some strongly progressive elements. All except Norway have higher top statutory personal income tax rates than the UK (note these Eurostat figures refer to period before Osborne abolished 50p rate in Budget 2012) …

...and these rates kick in at a lower threshold…

But rates and thresholds are far from the full story; the question is whether these higher rates and lower thresholds translate into high earners paying proportionately more? Interestingly, in regard to income taxes, it is in the UK where the richest decile contributes a significantly higher proportion of taxes. In Denmark, Norway and Sweden, the relationship between what the richest decile earn and pay in household taxes is very close; the dynamic in Finland is closer to the UK although the richest decile accounts for a significantly lower share of income.

The following table shows the distribution of household taxes (income taxes and employee social security contributions). Because taxes are deducted from household incomes, higher values of the concentration coefficient imply a more progressive distribution of household taxes.

As the OECD explains, ‘Taxation is most progressively distributed in the United States, probably reflecting the greater role played there by refundable tax credits such as the earned Income Tax Credit and the Child tax Credit. Overall, there is less variation in the progressivity of taxes across countries than in the case of transfers. After the United States, the distribution of taxation tends to be more progressive in the English speaking countries – Ireland, Australia, UK, New Zealand and Canada – together with Italy followed by the Netherlands, the Czech Republic and Germany. Taxes tend to be least progressive in the Nordic countries, France and Switzerland’. (Chapter 4, pg 104)

As I argued earlier, redistribution is achieved mainly by government transfers not taxes. See here for a good OECD summary of the issues and here, here and here for some provocative blog analysis.

3 Business taxes

Do the Nordic taxation systems provide evidence to support the Scottish Government’s view that corporation tax should fall in an independent Scotland?

In as much as the headline rate of corporate tax reveals anything at all, the latest data show that Scottish firms pay less than their Nordic counterparts. The divergence is hardly massive but will grow as UK rate hits 20% in 2015 unless Nordic nations also maintain the downward trajectory:

|

| compiled by STUC using OECD Tax Database see tables II. 1-4 |

However, the corporation tax headline rate isn’t a great guide to what firms actually pay: there are any number of allowances, deferrals and credits not to mention loopholes to be exploited. Therefore, the World Bank’s Total Tax Rate is a more reliable measure of comparative tax responsibilities (I try to avoid using the word ‘burden’ in this context!). This measures ‘the amount of taxes and mandatory contributions payable by businesses after accounting for allowable deductions and exemptions as a share of commercial profits. Taxes withheld (such as personal income tax) or collected and remitted to tax authorities (such as value added taxes, sales taxes or goods and service taxes) are excluded’.

The right hand column in the following table contains the total tax rate for UK, Nordics and OECD average. Denmark is something of an outlier; Finland and Norway are higher than the UK but (just) lower than the OECD average and Sweden is an outlier in the other direction. The Paying Taxes Rank is the position on the World Bank’s ease doing business rankings table on this particular measure i.e. Denmark ranks highest and is therefore considered to have the tax regime most conducive to doing business.

The next table shows the trend over the last five years in the total tax rate. Interestingly, the UK is the only nation where business tax is creeping up but, again, this reflects both attempts to reduce the recession/deficit rather than an indication of the long-term direction of policy and the fact that there is more to business taxation than the headline rate of corporation tax. Note the stability of Norway’s regime; a feature that is remarkably constant across most components of its tax framework.

However, although the total tax rate is a better measure of business taxation than the headline corporation tax, it fails to show how heavily businesses are taxed relative to other sectors of the economy...

4 Implicit Tax Rates (ITRs)

For this the best source is probably the implicit tax rates on capital, labour and consumption developed by Eurostat. These are ‘computed as the ratio of total tax revenues of the category (consumption, labour and capital) to a proxy of the potential tax base defined using the production and income accounts of the national accounts’. It goes on…'the consideration of tax revenue as a proportion of GDP provides limited information as no insight is given as to whether, for example, a high share of capital taxes in GDP is a result of high tax rates or a large capital tax base. These issues are tackled through the presentation of ITRs which do not suffer from this shortcoming…ITRs measure the actual or effective average tax burden directly or indirectly levied on different types of tax base or activities that could potentially be taxed by Member States…ITRs allow the monitoring of tax burden levels over time (enabling the identification of shifts between the taxation of different types of tax base e.g. from capital to labour) and across countries’.

An extensive explanation of Eurostat's methodology can be found here but worth quickly noting the scope of each category:

- Capital taxes - taxes on business income in a broad sense; not only taxes on profits but also taxes and levies that could be regarded as a prerequisite for earning profit;

- Labour taxes - all taxes directly linked to wages and mostly withheld at source paid by employees and employers including actual compulsory social contributions; and,

- Consumption taxes - taxes levied on transactions between final consumers and producers and on final consumption goods e.g. VAT.

What do the ITRs for capital, labour and consumption tell us?

That the UK taxes capital at similar levels to Norway and Denmark but much more than Sweden and Finland…

That there has been significant fluctuation in capital ITRs over recent years:

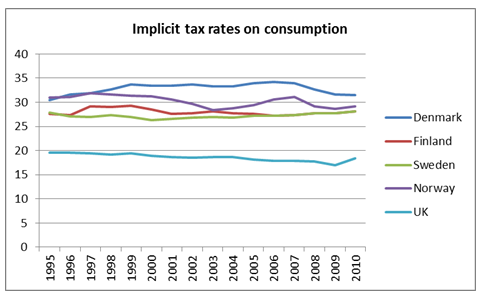

That the UK taxes consumption at much lower levels than the Nordics:

...and that this trend has changed little since 1995 despite the recent increase in UK VAT:

..and that the same is true for labour:

The UK and Norway have seen very constant levels over the past few years but there is a downward trend in the other Nordics:

Note: the eagle eyed among you will have noticed that employer social contributions are included in the labour calculation. Does the story change if these are removed and stuck into the capital calculation instead? It appears not, although given the way that the implicit rates are calculated it’s difficult to be precise. But a crude calculation using Eurostat figures for employer social contributions as a percentage of all taxation suggests the following results - the UK still has a much lower ITR on labour although the ITR on capital is significantly increased for Finland and Sweden:

|

| compiled by STUC using above Eurostat references for ITRs and Table A.3.1 |

5 Local taxation

A major difference between Scotland and the UK and the Nordic nations is the amount of taxation collected locally:

|

| compiled by STUC from Eurostat data (2012) see table B.3 |

Indeed, Sweden, Denmark and Finland are respectively the 1st, 2nd and 3rd most locally taxed nations in the EU; the UK 19th.

There are of course other components to a nation’s tax regime such as environmental taxes, energy taxes, transport fuel taxes etc. I could go on. But, as a percentage of both GDP and total taxation there is little significant difference between Scotland/UK and the Nordics on these measures.

6 Conclusions

So comparing tax systems is hardly straightforward and if the debate over what Scotland might learn from the Nordic model is to be developed then the need for some comprehensive research is obvious.

In the absence of such research being commissioned, what can be drawn with any certainty from the above analysis?

- the Nordic nations are highly redistributive economies that fund this redistribution through tax systems that, although quite different, are considerably less progressive than that currently operating in Scotland: workers and consumers pay proportionately more, capital and high income earners proportionately less. Maintaining comparatively very high levels of well paid employment is of course fundamental to this enduring success of this model. High levels of taxation are clearly compatible with both greater equality and economic dynamism;

- the Nordic tax systems may be more regressive but nevertheless manage to sustain much higher total tax revenues than more progressive systems; and,

- a much higher proportion of total tax revenue is raised at local level in the Nordic nations.

That ‘Nordic countries have higher than average spending and progressive benefit structures but less progressive tax systems’ is hardly conducive to identifying simple policy measures that could be transplanted here. The lessons for say, the US, from the above might be quite straightforward (introduce a consumption tax!). Scotland would be in a very different position; faced with a choice to tax more and perhaps less progressively?

Scotland is a comparatively unequal nation with a comparatively progressive tax system. The Nordics are comparatively (very!) equal nations with some of the most regressive tax systems in the developed world. There is clearly a lot of scope for drawing policy lessons which may be superficially plausible and stroke the prejudices of Right or Left but these are likely to be both simplistic and wrong.

But let me try to make a start:

- The shift towards a more Nordic style economic and social model (under independence or enhanced devolved powers) is likely to be long-term, will involve radical change in much more than the tax system and decisions on tax are likely to be difficult and, for those on the Left, very possibly counter intuitive;

- There are probably no single tax levers that will significantly increase the speed of this journey;

- Generating higher total tax revenues and using the additional revenue wisely (e.g. investing in the supply side of childcare – the opposite of what Osborne has just done in the Budget) should be the goal;

- But significantly increasing total revenues could prove very difficult in a jurisdiction currently characterised by high levels of poverty, inequality and low wage work, foreign ownership of private industry, a rapidly diminishing ‘social contract’ (does it even make sense to speak of such?) and, most importantly, an economy/ labour market highly integrated with its neighbours. As Gus O’Donnell argues, ‘Scope for radical change in Scotland is at least in some key areas of taxation likely to be limited by the degree of integration of the Scottish and UK economies’;

- Although it is always important to learn from success elsewhere, the opportunity provided by constitutional change is probably in designing a new system fit for Scotland’s needs as it finds itself in 2014/15/16. It’s a positive development that the Mirrlees report is now being promoted as the basis for such discussion although – again – easy policy solutions are highly unlikely to flow from such an exercise;

- It might be a shibboleth of the Left, but can too much can be made of progressivity? After all, taxes in the UK might be more progressive than in Sweden but rich people in Sweden pay much higher taxes than rich people in the UK. (Swedes in lower income deciles also pay more taxes but they are much more likely to be earning decent wages and working in reasonably secure jobs than comparable workers in Scotland). If this revenue is then redistributed, does it really matter whether the tax system is progressive? Rather than focusing on tax, much greater emphasis should be placed on other ways in which the Nordics manage to sustain greater equality such as much higher trade union density, wider collective bargaining coverage, comparatively huge investment in labour activation strategies etc.

Finally, the disparity in the proportion of taxation raised at local level is remarkable. Does this hint at another way of looking at the issue? Maybe better functioning democracies lead to better functioning economies rather than the other way round. I'll return to this and other issues in the next blog on economic development.