Spent the Budget participating in a Daily Record online forum. I was particularly taken with ‘Gasper’ who after 45 mins asked ‘if there was any news on fags?’ And the death of Liz Taylor caused a bit of a stir amongst fellow contributors. Tricky keeping up with the detail in these circumstances but it was good fun nonetheless (sorry Liz). In any case, the Chancellor’s statement is never, ever the full story (remember GB’s removal of the 10p tax rate?). Some surprising stories will undoubtedly emerge over the next few days as people work out the detail.

What did we learn from the speech?

Not much we didn’t already know. Gideon is a deregulator. Gideon doesn’t like talking about unemployment; particularly when it is high and rising as a result of his actions. Gideon couldn’t care less about vulnerable workers and the meagre protection afforded to them in the UK

Somewhat inconveniently for a ‘Budget for Growth’ it started with a downgrade of the OBR’s growth forecast from 2.1% to 1.7% for 2011; its growth forecast for next year is 2.5% compared to the OECD’s forecast of 2.0%. The forecasts have been raised for 2013 and 2014 but, as the FT has already noted, this is a mechanical extrapolation which does not reflect anything the OBR knows about these years.

Gideon couldn’t restrain himself from repeating his usual nonsense about the public finances:

“Our country’s fiscal plans have been strongly endorsed by the IMF, by the European Commission, by the OECD, and by every reputable business body in Britain

We could have an interesting debate about what constitutes a reputable business body; I’m certainly intrigued to learn whether the Chancellor believes any business bodies are disreputable….step forward the Institute of Directors

Anyway, it’s always worth reminding folk that until very recently the IMF, OECD, employer-body axis of ignorance disparaged anyone who dared, for instance, to suggest that financial innovation might have rendered the banking system less stable. Try the IMF’s 2006 Annual Report

Directors noted that the rapid growth in recent years of credit derivative and structured credit markets had facilitated the dispersion of credit risk by banks to a broader, more diverse group of investors, making the financial system more resilient and stable’. It went on, ‘While cyclical changes could well expose weaker segments and pockets of financial markets, the Board considered that these were unlikely to pose systemic risks….regulators should place greater reliance on the self-correcting forces of financial markets’.

It gets worse. Here is the IMF on Ireland in 2006, ‘In March 2006, an IMF team visited Dublin Ireland

The IMF’s view is also very inconsistent. The STUC’s Budget Submission quotes from the extensive research published in the IMF’s world outlook published in October 2010, ‘Fiscal consolidation typically has a contractionary effect on output. A fiscal consolidation equal to 1% of GDP typically reduces GDP by about 0.5% within two years and raises the unemployment rate by about 0.3 percentage points. Domestic demand – consumption and investment – falls by about 1%. Hardly stands up as a ‘strong endorsement of coalition policy does it?

But by now Gideon was in full and rather unpleasant flow:

“Market interest rates in Greece are 12.5%, in Ireland they are close to 10%, in Portugal and Spain Portugal , Greece and Spain , but we have virtually the same interest rates as Germany

Oh Lordy…how often must we rebut this claptrap. Anyone who wants to read a fuller analysis can find it here but for now let’s just focus on the five main reasons why the UK was never in danger of ‘becoming the next Greece’:

1. The UK is not in the Euro – we have control over fiscal and monetary policy; Sterling

2. Yes, the deficit is high by international standards but the stock of debt is not;

3. As Gideon points out, the cost of servicing UK debt is much lower than in the countries he mentions; the costs of servicing UK debt will rise from 1.6% of GDP in 2007 to 3.1% in 2014 – Greece is currently spending upwards of 12% of GDP;

4. The structure of debt is very different: around two thirds of UK debt is held internally (for instance, by you and me through our pension funds) and the maturity of UK UK

5. The UK UK

Gideon’s contention that low UK

“Markets have also been remarkably relaxed about funding these deficits: interest rates on index-linked gilts have been 1 per cent, or less, for more than a year; the yield on 10-year gilts has remained below pre-crisis levels and is now close to 3 per cent; and spreads over German bunds have been 1 percentage point, or less, throughout the crisis”.

From repetition of the most enduring myths of the current crisis, Gideon fast forwarded to the main thrust of his speech; the Budget was about making the UK the best place in the developed world in which to ‘start, grow and finance’ a business’. And boy did he trot out some well worn clichés…

“For this Budget confronts the hard truth that has been ignored for too long. Britain Britain Britain Britain

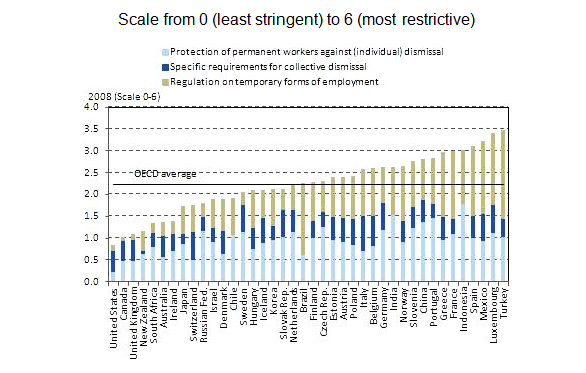

It is no surprise that Gideon is so attached to the World Economic Forum’s Competitiveness index – it is the only international survey that suggests the UK has become more regulated over the past decade (actually to be fair, its more complex than that – but an analysis of this particular survey will have to wait for another day). As covered in detail in our Budget submission (linked above), the evidence is very clear: the UK UK UK

So Government’s resources will be targeted at a non-problem. Indeed, most sane commentators, particularly those with any attachment all to the principles of fairness and equality would regard the UK UK

“In the last decade, countries like Germany , Denmark , Finland and the Netherlands

If this is true (and we’re back to that one survey again) it isn’t because they’ve deregulated. Germany , Finland and the Netherlands all have far more interventionist economies than the UK

The specific policies Gideon announced hardly conflate into a coherent and credible growth strategy:

· £350m worth of specific regulations will go – including the Equality Act’s costly dual discrimination rules;

· Lord Young’s recommendations on health and safety laws will be implemented in full;

· The no-win no-fee legal services that prey on employers will be restricted;

· existing regulation will be scrutinised by the public.

Is this it?! Is this a strategy for growth that will build a ‘more balanced economy by encouraging exports and investment’? Pitiful.

I’m going to leave an analysis of the various tax measures announced because 1) the TUC and Tax Research UK

The resources supposedly targeted at evasion and avoidance are wholly insufficient to deal with the scale of the challenge. Despite the bullish rhetoric, current policy is actually handing firms more opportunities to avoid and evade; key examples being enterprise zones (will just shift existing activity – no mention of the ‘deadweight’ issues that are always raised with active labour market interventions) proposals on foreign owned companies.

A couple of points on the green agenda. The full impact of the carbon floor price will only become apparent once the Government announces its intentions in other key areas of electricity market reform such as the Emissions Performance Standard, the replacement of the Renewables Obligation with Feed in Tarriffs (plus contracts for difference) and the Review of Ofgem’s role and remit. I can’t see how Gideon can conclude that this measure alone will ‘provide the incentive for billions of pounds of new investment in our energy infrastructure’.

The additional two billion pounds of funding for the Green Investment Bank is welcome but it is disappointing that it will be unable to borrow before 2015. The GIB’s resources are almost insignificant when set against the levels of investment required to achieve a genuinely low carbon economy. Even Gideon knows the market isn’t going to deliver on this one.

All in all, the Budget sidestepped the sustainable growth and jobs challenge. The FT’s influential Lex column has noted that, -

“While the political packaging makes sense, it points the arrow of causation the wrong way. Rather than a Budget for growth, it is a Budget that depends on growth…. If the expected growth does not arrive (as many economists currently fear), then lower tax receipts will limit the government’s ability to forment any fresh growth. What then can stimulate the economy?”

“While the political packaging makes sense, it points the arrow of causation the wrong way. Rather than a Budget for growth, it is a Budget that depends on growth…. If the expected growth does not arrive (as many economists currently fear), then lower tax receipts will limit the government’s ability to forment any fresh growth. What then can stimulate the economy?”

Gideon has no answers. My view is that he genuinely believes his scorched earth policy on regulation will produce the desired effect. The evidence suggests otherwise. Yes, there is a theoretical rationale for what he is attempting but most normal people thought the theory had died with the banking crisis. It is now abundantly clear that bad economic theory doesn’t die; indeed it seems that coalition policy is formulated only on the basis of zombie economics: deregulation, privatisation, trickle down and the Laffer Curve.

The UK Budget is very unlikely to grow more strongly as a result of this Budget. But we can be very confident that the UK

Stephen Boyd - STUC